Which side of Cashflow Quadrant should you be?

Most of the time, the investors do not need to get directly involved in the working of the business or assets where they invest, and hence they get plenty of time and freedom. They invest in businesses, stocks, real estates etc.

Cashflow quadrant summary free#

The investors are one of the most financially free group and they make their money work for them. You cannot jump into this quadrant without being successful in one of the three quadrants discussed above. Investors are the forth and the highest level of the cashflow quadrant. Tagline: “I’m looking for a good investment.”

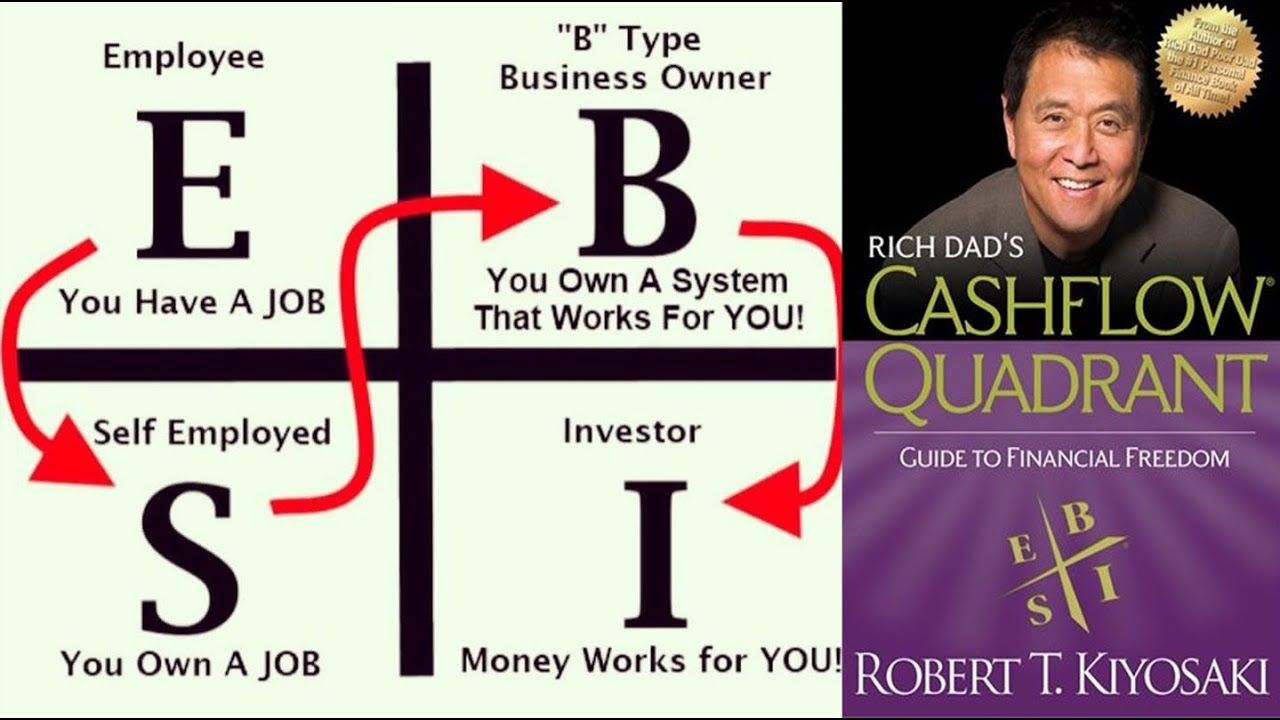

Even in their absence, their employee will work for them. For example, WhatsApp is a multi-billion company with even less than 50 employees working there.Īs compared to self-employed, who can’t stop working if he wants a regular income, the business owners do not need to trade his time with money as he owns the system. There are a number of big companies now, which do not require 500 employees to work. However, it the recent time, this rule is not completely valid. This group of people owns the system or process, where people work for them.Īccording to Forbes, big companies are the ones with over 500 employees. This is one of the best quadrants to get RICH. Tagline: “I’m looking for the smartest people in my company”. They own their job and many a time do all their work as they believe is ‘perfectionism’ and do not trust anyone else with the job.įew examples of self-employed are doctors, lawyers, retail shop owners, small company owners etc. They are sometimes also referred to ‘Solo-People’. Tagline: “If you want to do it right, you’ve to do it by yourself.” Moreover, our school, colleges, and university are also designed to create employees, who need security, live from pay-check to pay-check and want allowances.įor this group of people, job security is more important than the financial freedom.Īlthough you can become RICH working in this quadrant also, however it’s quite tough compared to the other cashflow quadrants. There is very few proportions of children who get advice to open their own business or to start investing, from their parents. Most of the people get the same suggestion from their Mom/Dad while growing up- “ Study hard, find a high paying job and have a secured life.” The reason why most people work in employee quadrant is that they are programmed to do so from the childhood. This is the default way of living and probably the most difficult quadrant to get rich. Majority of people work in this quadrant. Tagline: “I need a safe and secure job with benefits.” Let’s discuss few of the characteristics of each cashflow quadrant to understand them better. Moreover, our society needs all kind of these people to work efficiently. Investors- They make their money work for themĮach quadrant has their own advantages and disadvantages.Business owners- They own a system/process.Our working society is broadly divided into 4 kinds of people depending upon the work they perform. The answer is amazingly described in Robert Kiyosaki’s book- ‘ Rich Dad’s Cashflow quadrant’ which I’m going to discuss in this post. On the other hand, there are many people who never enjoy the rich life no matter how much hard work they do. There are a certain group of people who achieve financial freedom in their 30s. What engages the people more is why only a certain group of people are able to become rich?

The fact that the 5% of the population holds the 95% of the total wealth is really captivating.

Cashflow quadrant summary how to#

How to get RICH? Rich Dad’s Cashflow Quadrant Summary:

0 kommentar(er)

0 kommentar(er)